Metals in Electric Vehicles Battery Market Trends and Analysis by Metal Type, Battery Type, Application and Segment Forecast to 2030

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

The metals in EV battery market report provides an executive-level overview of the current market worldwide, with detailed forecasts of key indicators up to 2030. Published annually, the report offers a comprehensive analysis of short-term opportunities, competitive dynamics, and the changing demand landscape for metals in EV batteries. It covers various metal types, battery types, and applications at regional and country levels. Additionally, the report includes a thorough examination of key competitors and technology trends in the market.

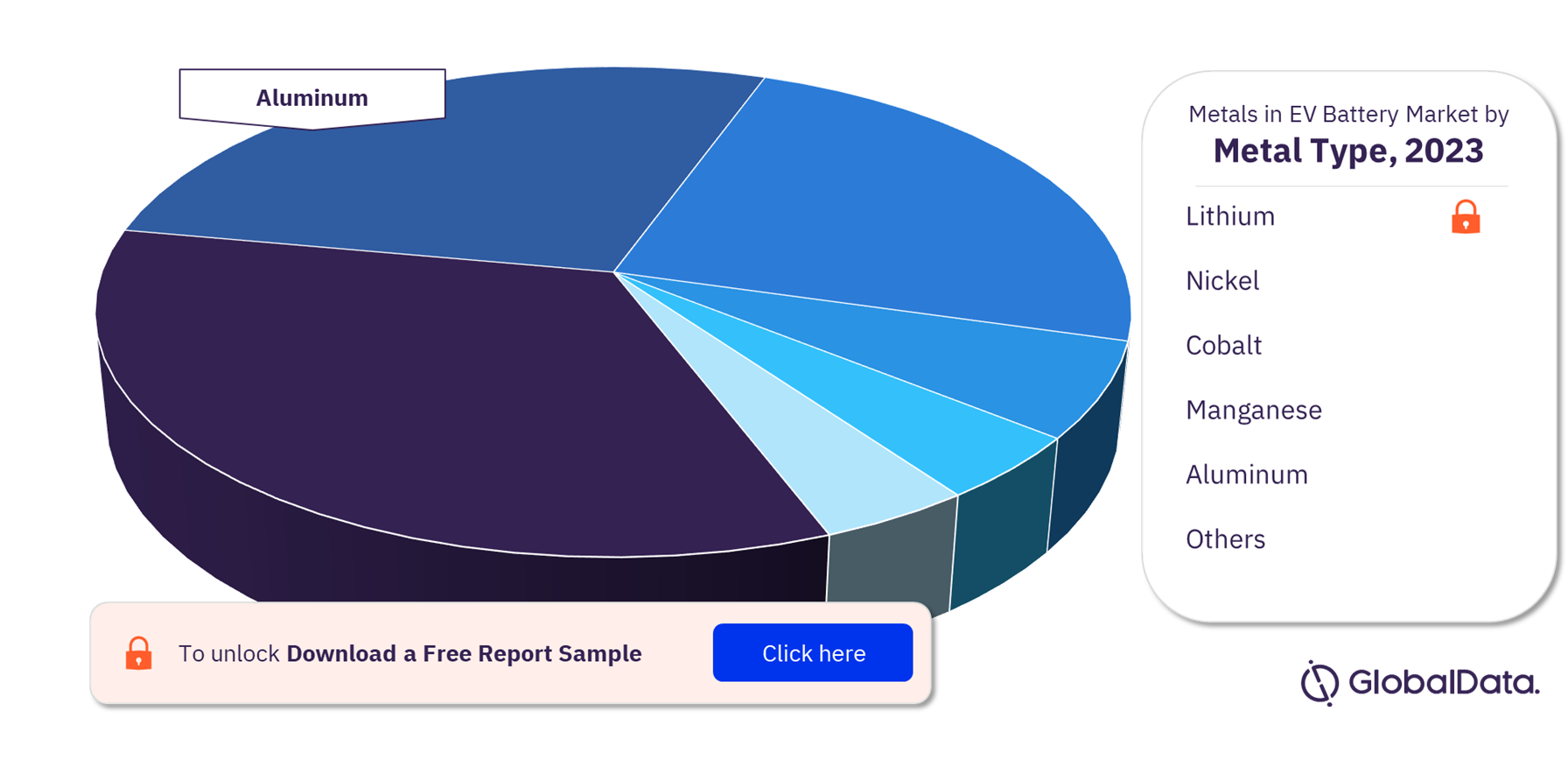

Metals in EV Battery Market Segmentation by Metal Type

By metal type, the metals in EV battery market are bifurcated into lithium, nickel, cobalt, manganese, aluminum, and others. Lithium is used in various EV battery technologies for manufacturing cell components. These include Lithium Manganese Oxide (LMO), Lithium Nickel Manganese Cobalt Oxide (NMC), and Lithium Iron Phosphate (LFP). Leading companies such as CBAK Energy, LG Energy Solution, Samsung SDI, BYD, CATL, SK Innovation, Tesla, Sanyo, and Northvolt are among the major customers of lithium metal for lithium-ion battery production.

Global Metals in EV Battery Market Share by Metal Type, 2023 (%)

Fetch sample PDF for segment-specific Volumes and shares, Download a Free Report Sample

Lithium is essential in the manufacturing of lithium-ion batteries, which are widely utilized in electric vehicles (EVs) due to their high energy density and efficient energy storage and release capabilities. Within the battery, lithium ions facilitate the movement between the cathode and anode during the charging and discharging processes, enabling the flow of electricity, and powering the vehicle. The growing demand for EVs has resulted in a substantial increase in the utilization of lithium for EV battery production.

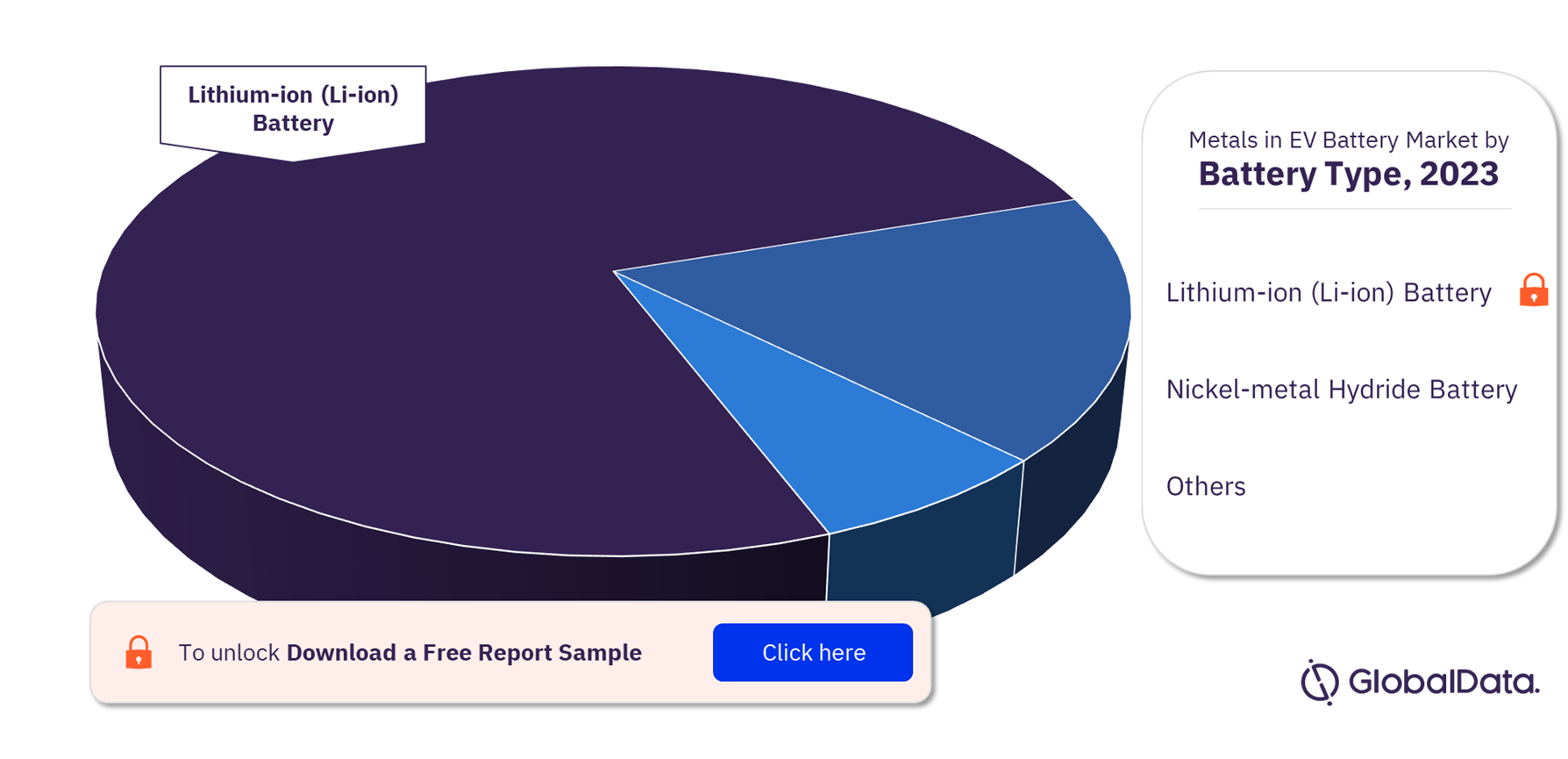

Metals in EV Battery Market Segmentation by Battery Type

Metals in EV battery market is categorized into various battery types, primarily consisting of lithium-ion (Li-ion), nickel-metal hydride, and other battery variants. The lithium-ion (Li-ion) battery segment holds the largest share in the metals in EV battery market and is expected to continue its dominance throughout the forecast period spanning from 2023 to 2030 in terms of volume.

Li-ion cells offer a significant advantage as they are not reliant on fossil fuels. Consumers, with an increasing focus on environmental awareness, are actively searching for ways to reduce their ecological footprint. EVs powered by Li-ion cells produce no direct emissions, and even when charged with electricity generated from fossil fuels, they still cause less environmental harm compared to traditional combustion-engine vehicles.

Global Metals in EV Battery Market Share by Battery Type, 2023 (%)

Metals in EV Battery Market Outlook Report with Detailed Segment Analysis is Available with GlobalData Now! Download a Free Report Sample

The nickel-metal hydride battery segment is holding the second position after Li-ion in terms of volume across the metals in EV battery market. The NiMH battery is a rechargeable battery that combines a nickel oxyhydroxide positive electrode with a hydrogen-absorbing negative electrode. It gained popularity as an alternative to lead-acid batteries in hybrid electric vehicles (HEVs).

NiMH batteries are considered environmentally friendly due to lower toxicity levels and the absence of hazardous heavy metals like cadmium. Additionally, NiMH batteries are considered safer than lithium-ion batteries due to their lower amount of active material. Unlike lithium-ion batteries, which have a risk of explosion when overcharged or short-circuited. These factors are supporting its growth in the global market.

Metals in EV Battery Market Segmentation by Application

The metals in EV battery market is segmented based on their use in personal and commercial electric vehicles. As of 2023, the personal vehicle segment has the highest market share in terms of volume and is projected to maintain its dominance in the coming years. This is due to the growing awareness among consumers about the long-term benefits of electric vehicles over traditional combustion engine vehicles. Additionally, governments are offering subsidies for the purchase of personal electric vehicles, further driving the market growth and supporting the objective of reducing CO2 emissions through green transportation.

Global Metals in EV Battery Market Share, by Application, 2023 (%)

Metals in EV Battery Market Outlook Report with Detailed Segment Analysis is Available with GlobalData Now! Download a Free Report Sample

The commercial vehicle segment is projected to exhibit the fastest growth of 28.6% over the forecast period from 2023 to 2030 across the metals in EV battery market. The commercial electric vehicle segment is witnessing notable expansion as more businesses and industries embrace electric vehicles for their transportation requirements. This growth is propelled by various factors, including increasing environmental awareness, government incentives and regulations, advancements in battery technology, and the drive to reduce operating costs and carbon emissions. Furthermore, the ongoing advancements in electric vehicle technology and the expanding charging infrastructure, the commercial electric vehicle market is expected to sustain its upward trajectory in the foreseeable future.

Metals in EV Battery Market Analysis by Region

The Asia Pacific region has emerged as the leader in the metals in EV battery market and this dominance is largely attributed to the presence of major metal manufacturing companies in China. China plays a crucial role in battery metals mining, focusing on key metals like lithium, cobalt, and nickel that are essential for EV battery production. The country has made substantial investments in mining projects to meet the increasing demand for these metals. Leading Chinese companies such as Ganfeng Lithium, CATL, and Tianqi Lithium have established themselves as key players in the metals in EV battery market. Furthermore, China has successfully developed a robust supply chain encompassing mining, processing, and refining capabilities, further solidifying its position as a dominant force in the global metals in EV battery market.

Asia-Pacific Metals in EV Battery Market Share by Country, 2023 (%)

View Sample Report for Additional Metals in EV Battery Market Insights, Download a Free Report Sample

Europe holds the second-largest market for metals in the EV battery industry globally and is expected to witness substantial growth during the forecast period. The growth of the metals in the EV battery market in Europe is attributed to several factors, including government initiatives aimed at promoting carbon-negative transportation, stringent environmental regulations, and the increasing adoption of electric vehicles. These factors combined contribute to the region’s favorable conditions for the expansion of the metals in the EV battery market.

Europe is actively driving the shift towards electric mobility by making substantial investments in EV battery production and infrastructure development. The region boasts a strong presence of key players in the EV battery market, including renowned automakers and battery manufacturers. Furthermore, the European Union has introduced initiatives aimed at enhancing the supply chain for crucial battery raw materials and advancing battery research and development. Europe is well-positioned to play a pivotal role in shaping the future of the metals used in EV batteries with a firm commitment to sustainability and innovation.

Metals in EV Battery Market - Competitive Landscape

The companies involved in the metals in EV battery market are expected to witness a substantial increase in demand in the coming years. As a result, these companies are actively planning to enhance their manufacturing capabilities by expanding their processing operations and securing investments. This strategic approach aims to strengthen their processing capabilities to meet the anticipated surge in demand from the growing EV battery industry.

Key players in the metals in EV battery market include Glencore International AG, Sociedad Quimica y Minera de Chile (SQM), Albemarle Corporation, Ganfeng Lithium Co. Ltd., AngloAmerican PLC, Tianqi Lithium Corp., Vale S.A., China Molybdenum Co., Ltd., Eurasian Resources Group, Norilsk Nickel, Eramet, and Freeport-McMoRan.

Segments covered in the Report

Leading Players in the Metals in EV Battery Market

- Glencore International AG

- Sociedad Quimica y Minera de Chile (SQM)

- Albemarle Corporation

- Ganfeng Lithium Co. Ltd.

- AngloAmerican PLC

- Tianqi Lithium Corp.

- Vale S.A.

- China Molybdenum Co., Ltd.

- Eurasian Resources Group

- Norilsk Nickel

- Eramet

- Freeport-McMoRan

To Know More About Leading Metals in EV Battery Market Players, Download a Free Report Sample

Metals in EV Battery Market Segments and Scope

GlobalData Plc has segmented the metals in EV battery market report by metal type, battery type, application, and region:

Global Metals in EV Battery Market Metal Type Outlook (Volume, Thousand Tonnes 2020-2030)

- Lithium

- Nickel

- Cobalt

- Manganese

- Aluminum

- Others

Global Metals in EV Battery Market Battery Type Outlook (Volume, Thousand Tonnes 2020-2030)

- Lithium-ion (Li-ion) Battery

- Nickel-metal Hydride Battery

- Others

Global Metals in EV Battery Market Application Outlook (Volume, Thousand Tonnes 2020-2030)

- Personal Vehicles

- Commercial Vehicles

Global Metals in EV Battery Market Regional Outlook (Volume, Thousand Tonnes 2020-2030)

- North America

- US

- Canada

- Europe

- Germany

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Korea

- Rest of Asia Pacific

- Central & South America

- Brazil

- Rest of Central & South America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Scope

The market intelligence report provides an in-depth analysis of the following –

• Metals in EV battery market outlook: analysis as well as historical figures and forecasts of volume opportunities from the metal type, battery type, application, and regional segments.

• The competitive landscape: an examination of the positioning of leading players in the metals in EV battery market.

• Company Analysis: analysis of the market position of leading service providers in the metals in EV battery market.

• Underlying assumptions behind our published base-case forecasts, as well as potential market developments that would alter, either positively or negatively, our base-case outlook.

Key Highlights

The metals in EV battery market size was estimated at 3.9 million tonnes in terms of volume in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 13.4% over the forecast period. The metals in EV battery market report provides an executive-level overview of the current market worldwide, with detailed forecasts of key indicators up to 2030.

Reasons to Buy

• This market intelligence report offers a thorough, forward-looking analysis of the global metals in EV battery market by metal type, battery type, application, and key opportunities in a concise format to help executives build proactive and profitable growth strategies.

• Accompanying GlobalData’s forecast products, the report examines the assumptions and drivers behind ongoing and upcoming trends in metals in EV battery markets.

• With more than 120 charts and tables, the report is designed for an executive-level audience, boasting presentation quality.

• The report provides an easily digestible market assessment for decision-makers built around in-depth information gathered from local market players, which enables executives to quickly get up to speed with the current and emerging trends in metals in EV battery markets.

• The broad perspective of the report coupled with comprehensive, actionable detail will help mining sector stakeholders, service providers, and other metals in EV battery players succeed in growing the metals in EV battery market globally.

Sociedad Quimica y Minera de Chile (SQM)

Albemarle Corp.

Ganfeng Lithium Group Co. Ltd.

Anglo American PLC

Tianqi Lithium Corp.

Vale S.A.

CMOC Group Ltd.

Eurasian Resources Group

MMC Norilsk Nickel

Eramet SA

Freeport-McMoRan

Table of Contents

Table

Figures

Frequently asked questions

-

What will be the metals in EV battery market size in 2023?

The metals in EV battery market size globally was evaluated at nearly 3,986.2 thousand tonnes in 2023.

-

What is the metals in EV battery market growth rate?

The metals in EV battery market is expected to grow at a CAGR of 15.1% during the forecast period (2023-2030).

-

What is the key metals in EV battery market driver?

The increasing focus on environmental consciousness and the transition towards sustainable transportation are expected to be key drivers responsible for the expansion of the metals in EV battery market during the forecast period.

-

What are the key metals in EV battery market segments?

Metal Type Segments: Lithium, Nickel, Cobalt, Manganese, Aluminum, Others

Battery Type Segment: Lithium-ion (Li-ion) Battery, Nickel-metal Hydride Battery, Others

Application Segments: Personal Vehicles, Commercial Vehicles

-

Which are the leading metals in EV battery companies globally?

The leading metals in EV battery companies are Glencore International AG, Sociedad Quimica y Minera de Chile (SQM), Albemarle Corporation, Ganfeng Lithium Co. Ltd., AngloAmerican PLC, Tianqi Lithium Corp., Vale S.A., China Molybdenum Co., Ltd., Eurasian Resources Group, Norilsk Nickel, Eramet, and Freeport-McMoRan.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Mining reports